Trade 5x Serax refers to leveraged trading of the Serax cryptocurrency. It allows traders to amplify their potential profits by borrowing funds. With 5x leverage, traders can control a position five times larger than their initial investment. This approach can lead to significant gains but also carries heightened risks.

“Trade 5x Serax: Common Mistakes and How to Avoid Them”? Trading with leverage can be exciting but treacherous. Many traders fall into common pitfalls that can lead to substantial losses. Understanding these mistakes is crucial for success in the volatile crypto market.

Serax is a promising cryptocurrency known for its focus on security and efficiency. Trading it with 5x leverage requires careful strategy and risk management. Successful traders balance the potential for high returns with the need for caution. They stay informed about market trends and adapt their approach accordingly.

Overview of Serax

Serax is a new and exciting cryptocurrency. It’s designed to make payments faster and cheaper than traditional banks. Serax uses special technology to keep your money safe and private.

People are getting interested in Serax because it’s fast and secure. It’s different from other cryptocurrencies because it focuses on keeping your information secret. This makes it a popular choice for those who care about privacy.

Common Mistakes when Trading Serax

Trading Serax can be tricky, especially if you are new. Here are some common mistakes to watch out for:

- Not doing enough research: Many people jump in without learning about Serax first.

- Trading with emotions: Letting fear or greed control your decisions is dangerous.

- Forgetting about risk: Not having a plan to protect your money can lead to big losses.

- Ignoring stop losses: These tools can save you from losing too much, but some traders don’t use them.

- Trading too much: Trying to make too many trades can actually hurt your chances of success.

- Not watching the market: Failing to keep up with news and trends can leave you in the dark.

- Chasing losses: Trying to win back money you have lost often leads to more losses.

- Putting all your money in one place: It is risky to only invest in Serax and nothing else.

- Not keeping records: If you do not track your trades, you can’t learn from your mistakes.

- Sticking to old habits: The market changes, so your strategies need to change too.

Importance of Research and Analysis

Research and analysis are key to successful Serax trading. They help you make informed decisions and spot opportunities.

Market Trade 5x serax

Watch how Serax prices change over time. Look for patterns in the ups and downs. See if prices are mostly going up or down. Understanding these trends helps you trade 5x serax smarter.

Notice what other traders are doing. If many people buy Serax, the price might rise. If they sell, it might fall. Spotting these trends early can give you an advantage.

News and Events of Trade 5x serax

Stay updated on Serax news. Big announcements can change prices fast. Look for updates from the Serax team about new features or partnerships.

Follow general crypto news too. Big events in Bitcoin or Ethereum can affect Serax. Set up alerts on your phone for important Serax news. This keeps you informed.

Technical Analysis

Technical analysis is like reading price charts. You study past prices to guess future moves. Learn about support and resistance levels. These are prices where Serax often stops falling or rising.Try using moving averages. These show average prices over time. When prices cross these lines, it might signal a change.

Start with basics and practice.No method is perfect. Use technical analysis with other research. It’s one tool to help you make better trades. The more you practice, the better you’ll get at finding useful patterns.

Read Also this: Miracoup Product Review: Everything You Need to Know in 2024

Utilizing Stop Losses to Minimize Risk

Stop losses are like safety nets for your Serax trades. They automatically sell your Serax if the price drops too low. This helps protect your money from big losses. It is a smart way to manage risk when trading.

Setting stop losses takes some thinking. You need to decide how much loss you are okay with. Maybe you are comfortable losing 5% or 10% on a trade. Once you decide set your stop loss at that point. This way, you won’t lose more than you are willing to.

Using stop losses does not mean you will always avoid losses. But it does help keep them smaller.Trade 5x serax is especially helpful when the market moves quickly. You might not always be watching, but your stop loss is working for you.

Diversifying Your Portfolio with Other Cryptocurrencies

Putting all your money in Serax can be risky. It is smarter to spread your investments around. This is called diversifying. Trade 5x serax means buying different types of cryptocurrencies. This way, if Serax goes down, you might still be okay.

Consider adding well-known coins like Bitcoin or Ethereum to your portfolio. These are often more stable than newer coins. You could also look at some promising new projects. Just make sure to research them carefully first.

Diversifying does not mean buying every coin you see. Pick a few that you understand and believe in. Maybe choose 3-5 different cryptocurrencies to start. This gives you a good mix without spreading yourself too thin.

How to Avoid These Mistakes from Trade 5x serax

The best way to avoid mistakes is to learn and practice. Start by reading about Serax and cryptocurrency trading. There are lots of free resources online. Watch videos join forums and follow experienced traders on social media. The more you learn the better prepared you will be.

Don’t rush into trading with real money. Try using a demo account first. This lets you practice without risking your own cash. Make pretend trades and see how they work out. When you feel confident and are making good decisions consistently then think about trading with real money.

Trading with emotions of Trade 5x serax

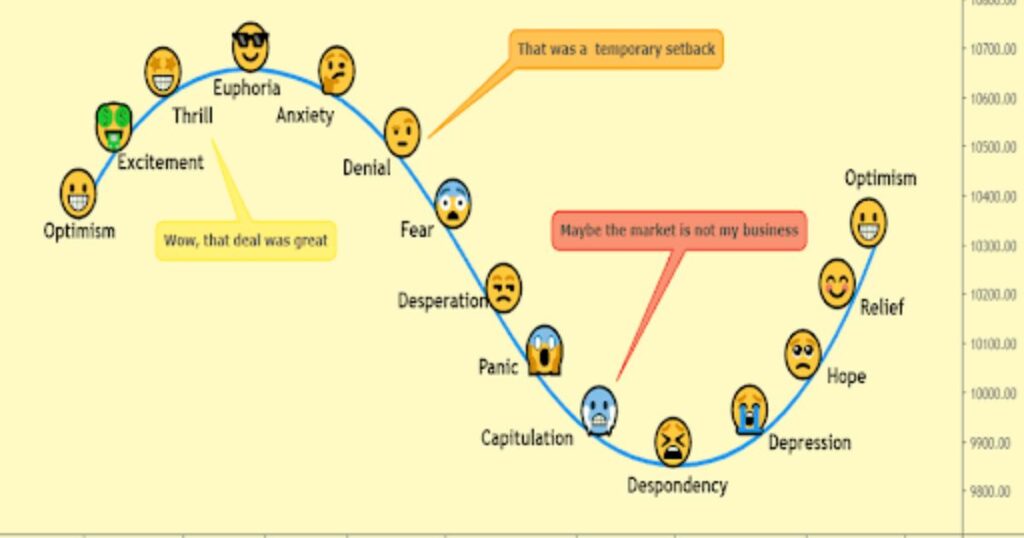

Emotions can mess up your Serax trades. Fear and greed are big troublemakers. When prices drop, fear might make you sell too soon. When prices rise, greed might make you hold on too long. It’s important to stay calm and stick to your plan. Don’t let short-term price swings scare you. Remember, good trading is about thinking long-term, not reacting to every little change.

Not having a trading plan for Trade 5x serax

A trading plan is like a map for your Serax journey. It helps you know what to do in different situations. Without a plan, you might make quick decisions that are not smart.

Take time to write down your goals and strategies. Include things like how much you’ll invest and when you’ll buy or sell. Having a clear plan helps you stay focused and avoid costly mistakes.

Also see: Exploring the Charm of Hearts: A Wallpaper Collection

No risk management

Risk management is super important when trading Serax. Never risk more money than you can afford to lose. Set clear points for when you will enter and exit trades. Use tools like stop-loss orders to protect your investment. Remember, keeping your money safe is just as important as trying to make more. Good risk management helps you stay in the game longer.

Letting losers run

It’s tempting to hold onto losing Serax trades, hoping they’ll turn around. But this can lead to bigger losses. Set a limit for how much you’re willing to lose on a trade. If it goes past this point, sell and move on. Don’t let your feelings keep you in a bad trade. Holding onto losers too long can eat up your money and opportunities. It’s often better to accept a small loss than risk a big one.

Not identifying your Trade 5x serax

Everyone has a unique way of trading that suits them best. Some people like quick trades that last a few hours. Others prefer holding onto trades for days or weeks. It is important to find what works for you.Your trading style should match your personality and schedule. This way you will feel more comfortable and confident in your trades.

Trading multiple markets

Trying to trade 5x serax too many different cryptocurrencies at once can be overwhelming. It is hard to keep track of everything happening in multiple markets. You might miss important changes or make rushed decisions. Instead, focus on just a few markets you understand well. Start with Serax and maybe one or two others. It is better to know a lot about a few markets than a little about many. As you get more experienced you can slowly add more markets to your trading.

Starting on a live account

It is tempting to jump right into trading Serax with real money. But this can be risky if you are new. You might lose a lot of money before you learn how things work.A better way is to start with a practice account. Many trading platforms offer these for free. You can trade 5x serax with fake money to learn the ropes.

This way, you do not risk your real savings while you are still learning.Once you have practiced and feel confident, then you can try trading with real money. Start small and gradually increase as you get better. This approach helps protect your money while you gain experience.

Not learning

The world of cryptocurrency is always changing. What works for trading Serax today might not work tomorrow. It’s important to keep learning new things. Read about trading strategies, follow crypto news, and watch what successful traders do. Don’t be afraid to ask questions or admit when you don’t know something.

Everyone starts as a beginner. Try to learn from your mistakes instead of getting discouraged. Set aside some time each week to study and improve your skills. The more you learn, the better trader you’ll become.

Final thoughts of Trade 5x serax

trading Serax with 5x leverage offers significant profit potential but it also comes with substantial risks. To succeed, traders must avoid common pitfalls such as trading on emotions, neglecting risk management and failing to stay informed about market trends.

Utilizing stop-loss orders diversifying investments and continuously learning about the market are essential strategies for minimizing losses and maximizing gains. By approaching leveraged trading with caution, discipline, and a well-developed plan traders can better navigate the complexities of the volatile cryptocurrency markets.

Frequently Asked Questions

What is 5x leverage in Serax trading?

5x leverage allows you to control a position five times larger than your initial investment, amplifying both potential profits and risks. It’s crucial to manage this carefully to avoid significant losses.

Why is risk management important in leveraged trading?

Risk management helps protect your capital by setting limits on potential losses such as using stop-loss orders. Without it, leveraged trading can lead to substantial and rapid financial losses.

How can I avoid emotional trading?

Stick to a well-defined trading plan and avoid making impulsive decisions based on fear or greed. Staying focused on long-term goals helps prevent emotional reactions to short-term market movements.

What is the role of technical analysis in Serax trading?

Technical analysis involves studying past price movements to predict future trends. It is a valuable tool for identifying entry and exit points, but it should be used alongside other research methods.

Why should I diversify my cryptocurrency portfolio?

Diversifying reduces risk by spreading investments across different assets. This way, if one cryptocurrency underperforms, others in your portfolio can help balance the overall risk.

What is a stop-loss order and how does it work?

A stop-loss order automatically sells your position if the price drops to a specified level, limiting your losses. It is an essential tool for managing risk in volatile markets

A stop-loss order automatically sells your position if the price drops to a specified level, limiting your losses. It is an essential tool for managing risk in volatile markets